The comeback of European shares ?

There is further potential for European equities to outperform this year, says Christian Schmitt, Senior Portfolio Manager at Ethenea. Unfortunately, the current situation is not sufficient to be able to assume a sustained comeback in European equities.

For years, many international investors have tended to steer clear of European equities - and have tended to do quite well. Since the global financial crisis of 2008/09, the relative development of the major European stock indices compared to their US counterparts knew only one direction: down! In the 20 years or so before that - the length of time that the German DAX or the backward-looking European STOXX indices, for example, have been around - the relative performance was much more balanced. “But a structural outperformance of European shares was not to be found there either,” says Christian Schmitt, Senior Portfolio Manager at Ethenea.

In February 2022 - with the start of the Russian war of aggression on Ukraine - the list of challenges currently facing the old continent was once again dramatically extended. It is all the more astonishing for many market observers that the European stock market has outperformed the US stock market not only in the current year 2023, but also in the calendar year 2022. Are investors with a cautious view of Europe perhaps overlooking something?

“In principle, the performance of shares, both at the level of individual stocks and aggregated at index level, depends both on the fundamental development of the underlying companies and on the respective valuation,” says Christian Schmitt. “The longer the observation period, the more dominant the development of sales, profits, cash flows and other fundamental key figures. In other words, valuation differentials can be a good (tactical) starting point for relative outperformance. For a long-term (strategic) outperformance, however, fundamental growth must also develop significantly better.”

Justified valuation discount

A picture is worth a thousand words. So, let's first take a look at the initial situation and the relative development of the influencing factors mentioned in recent years.

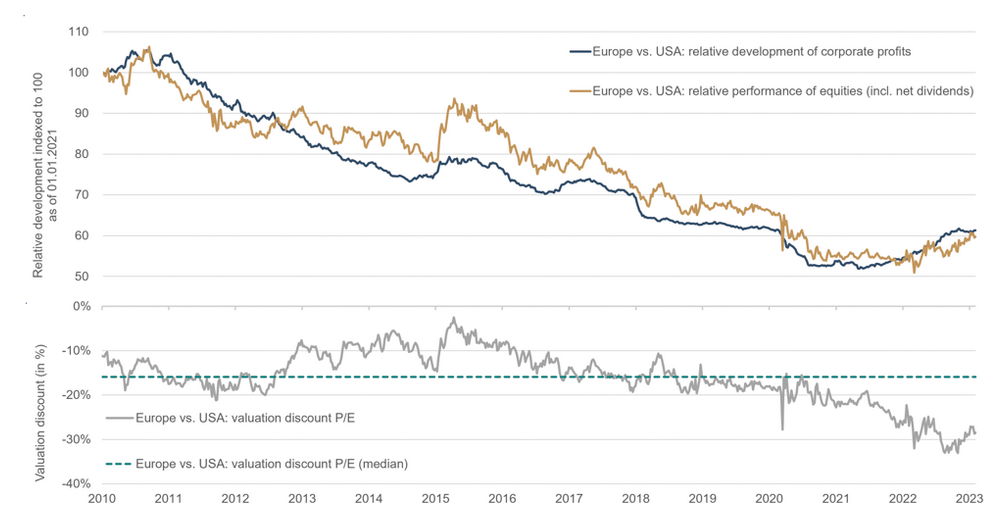

The upper part of the graph shows the relative price development of European stocks compared to US stocks (golden line). Also, the relative development of expected corporate profits over the next 12 months is shown (blue line). Both time series are indexed to 100 as of January 1st, 2010. For example, a move from 100 to 90 means that Europe has underperformed by 10% relative to the US. The lower part of the chart reflects Europe's valuation discount versus the US using price-earnings multiples. While European equities are priced at a factor of 13.0 based on expected earnings over the next 12 months, US equities have to pay 18.2 times expected earnings. Christian Schmitt : “From a European perspective, this results in a current valuation discount of -29% (grey line). In contrast, the median for the past 13 years was 16% (green dashed line).”

The graphic representation shows two things. Over the long term, the significantly better performance of US equities was largely underpinned by corresponding fundamental developments. In addition, a certain valuation discount for European shares seems justified, which from different industry structures, lower levels of profitability, more tightly regulated and fragmented home markets, less energy self-sufficiency and an overall more social capitalism. However, it is also evident that Europe's valuation discount (not only) reached new extremes with the start of the war in Ukraine last year. At the same time, the fundamental development was surprisingly strong compared to the USA. In addition, there is a bias towards underweight Europe in many global portfolios. Schmitt : “This constellation explains the strong performance of the European share indices in recent months, especially since the energy crisis was much more relaxed than many expected due to the mild winter.”

“Going forward, there is further potential for European equities to outperform as the valuation discount remains above average,” says Christian Schmitt. “A return to the above median alone would equate to a further outperformance of around 18%.”

Less rosy future

The starting point for a continuation of the fundamental (relative) momentum does not look quite so rosy. There were a few special situations here last year, which have now largely been resolved. For example, there was a special boom for the technology-heavy US stock indices in the pandemic years 2020/21, the enormous base effects of which led to significant headwinds in 2022. A significant proportion of the investments and purchases made turned out to be early sales, not additional sales. In addition, the strong USD weighed on global US companies, while many European exporters benefited from the weak euro. “With these trends coming to an end, relative profit expectations have moderated again in the last five months,” says Christian Schmitt. “A continuation of the positive fundamental momentum in 2023 therefore seems unlikely. On the other hand, an opposite development to the detriment of Europe is not foreseeable.”

The bottom line is that the valuation argument is the main one, which can only support Europe's relative strength to a limited extent. Schmitt concludes : “Unfortunately, the current situation is not sufficient to be able to assume a sustained comeback in European equities.”